Analysis firm Tinuiti has released a new report examining, among other things, the different motivations of gamers, finding a significant gulf between Gen Z and baby boomers in their approach to gaming.

Overall, relaxation and unwinding is listed as the most popular primary motivation, at 42% overall. 51% of baby boomers class this as their primary driver, compared to just 31% of Gen Z gamers.

In contrast, 34% of gamers class gaming’s ability to entertain as more important, with a much smaller gap – 35% of Gen Z respondents listed it as their primary motivation, compared to 32% of baby boomers. This suggests that Gen Z gamers are more inclined to play games which are less relaxing in nature, such as competitive games.

Notably, while 11% of Gen Z gamers and 9% of baby boomers (an average of 11% overall) claim their primary motivation is winning, Gen Z users were more likely to choose “It’s a good way to keep up with friends” (12% vs. 3% for baby boomers, for an average of 7%) or “It’s a good way to meet people” (8% vs. 3% for an average of 5%). This suggests that Gen Z gamers are more inclined to play games socially or competitively.

Notably, an average of 44% of gamers across demographics stated that they feel more competitive in the world of gaming, compared to just 12% who claim to be less competitive.

Mobile thrives on broad appeal

Mobile proved to be the most popular gaming platform of all, with 78% of gamers admitting to playing mobile games. The platform proved particular popular among Gen Z and Gen X, with 80% of gamers in both categories using it. This was followed by millennials (78%) and baby boomers (75%).

Tellingly, only one other category, PC gamers among Gen Z users, exceeded 60%, hitting 65%. However, it should be noted that Tinuiti separates the three most popular consoles into their own category, with PlayStation proving the most popular.

Despite its popularity, the data suggests that younger generations are less likely to list mobile as their primary gaming platform. 44% of users in total list themselves first and foremost as mobile gamers, but there’s a distinct downward trend: While 57% of baby boomers and 52% of Gen X’ers list mobile as their primary platform, there’s a steep drop in popularity after that to 37% of millennials and 29% of Gen Z’ers.

In contrast, PC gamers are the preferred platform of 21% of gamers, proving most popular among baby boomers (31%) and Gen Z (29%). Again, however, console is split into three separate categories.

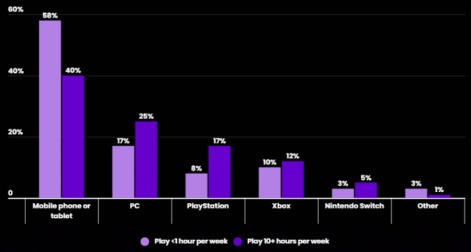

Mobile also seemed to attract more casual gamers than other platforms, being the only category where more people reported playing for less than an hour (58%) than over 10 hours (40%). This suggests that those who primarily play games on PC or consoles are more likely to be devoted gamers willing to invest significant free time into playing. While mobile still has more devoted players than all three consoles combined, the data suggests that mobile’s popularity lies, at least partly, in accessibility and a broad appeal compared to other gaming platforms.

Marketing matters

Gaming offers diverse opportunities for monetisation, and may allow brands to grow their influence with gamers.

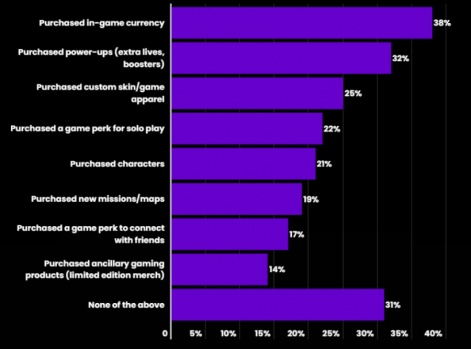

A total of 69% of gamers admit to making at least one in-game purchase of some kind, whether that’s currency, DLC, or cosmetic items. Additionally, 17% of respondents have purchased a game to play with their friends, while 14% have purchased ancillary products such as merchandise.

Despite the prevalence of in-game purchases in mobile games, such as energy or power ups, mobile games lag somewhat in terms of share of in-game purchases, with only 58% of respondents doing so. In contrast, a combined 86% of console players have made in-game purchases, with the Nintendo Switch leading the way at 90%. This may be due, in part, to the massive popularity of Nintendo franchises such as Pokemon and The Legend of Zelda, with many fans willing to purchase high-ticket items such as DLC. Tinuiti notes that this mobile’s more casual player base means that players are less inclined to make in-game purchases than on other platforms.

When asked what forms of gaming-related marketing players preferred, there was a strong preference towards brand-sponsored add-ons available for free, with it being the preference of 34%. This was followed by gaming content such as series’ and articles produced by brands (24%) and intrinsic in-game advertising such as banners and in-game billboards (16%).

This suggests that while players are open to the idea of game-related marketing, there’s a strong preference for methods that either don’t intrude on the game itself or else can add something new to the experience. Notably, 39% of respondents admit to purchasing a product they’ve discovered through in-game marketing in the last year.

Tinuiti notes the potential of rewarded video ads in particular, as these offer a good value exchange without detracting from the gameplay.