Although the impact of the global pandemic is still being felt in the commercial office space market, many parts of the world are now moving towards living with the COVID-19 rather than operating with strict restrictions, office leasing data shows.

With 5.4 million square feet of net occupancy growth across the US, office leasing rates in the fourth quarter of 2021 were positive for the first time since the onset of the pandemic. Leading the uptick: leasing rates in secondary-growth markets (cities with populations between 1 and 5 million people).

Tech remained the dominant leasing driver through the end of 2021, representing 21% of Q4 activity, according to Jones Lang LaSalle IP (JLL), a commercial real estate and investment management services firm. High-tech firms continued to dominate the office leasing space, adding about 3.3 million square feet of leased office space in the quarter.

“Big tech, in general, has expanded by 10.1 million square feet over the course of the pandemic,” said Phil Ryan, US research director at JLL.

Jones Lang LaSalle IP

Jones Lang LaSalle IPOffice leasing rates, however, are still below pre-pandemic levels, though tenant demand is expected to rise incrementally throughout 2022 due to favorable conditions, the JLL report said.

For the first time in two years, more office space was leased than vacated in Q4 2021. Overall, leasing activity rose by 9.2% in the last three months of 2021, bringing quarterly volumes to 71.3% of pre-pandemic norms.

Leasing and occupancy, however, are two different things. Leasing refers to space expected to be occupied, not actual employees seated behind desks.

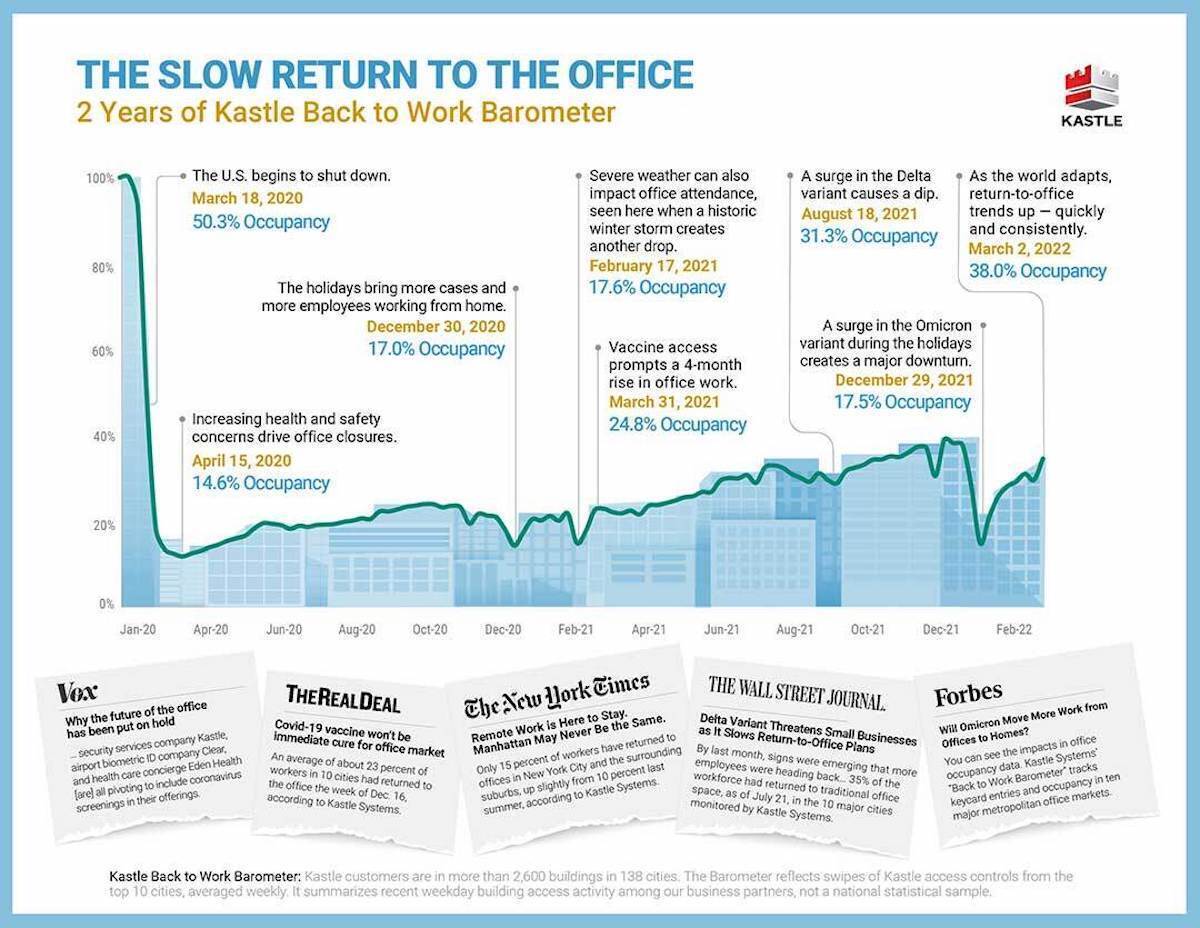

This month, the average occupancy rate on Kastle System’s Back to Work Barometer rose to 40.5%, up from 39% in November 2021. That’s the highest rate since March 2020, and every city on the Back to Work Barometer saw occupancy gains. (The barometer measures occupancy rates in 10 metropolitan areas, including New York City, Chicago, Houston, and Washington D.C.)

Kastle Systems

Kastle SystemsKastle Systems Back to Work Barometer.

Kastle Systems is a managed security provider to more than 10,000 companies globally; it uses employee badge-swipe data to determine workplace occupancy.

According to workplace technology firm Freespace, however, US office occupancy rates rates have been on a roller-coaster ride over the past four months, moving between 11% occupancy in November, 2021, to 3% in January, and finally raising back up to 6% this month.

In early May, 2021, just one in 20 office buildings in the US had occupancy levels above 10%, and as recently as last month occupancy rates averaged just 16%. Looking ahead to 2022, about one in five offices are expected to be empty, according to Moody’s Analytics, a consultancy.

“We’re still at the point where the majority of people aren’t even in an office,” Ryan said. “In terms of demand moving forward, the general consensus is there will be a net decrease in the demand of space with relationship to existing footprints. For the market overall, however, it’s less certain, because there is also net growth in terms of the labor force and in terms of the overall number of people who’ll need some level of office access.”

Freespace

FreespaceUS occupancy levels, 2021-22.

Uncertainty remains a key theme going forward because there are still concerns around new Covid variants, emerging geopolitical issues and elevated inflation, the JLL report said.

While leasing activity is up, office vacancies are also expected to trend up throughout 2022 due to construction completions begun prior to the pandemic and corporate office consolidations.

One trend affecting occupancy volumes is a consolidation of existing space; in other words, organizations are making more efficient use of the space they’ve already leased to accommodate a hybrid workforce. Another trend is more organizations are choosing to lease new or renovated buildings over older stock. More and more, older office space is being converted into residential space or senior living or assisted living facilities, according to Peter Miscovich, managing director of JLL.

“There is premium to be paid for class A space in New York, Boston, San Francisco, and London,” Miscovich said in an eariler interview. “I don’t think we’ll ever return to the behaviors of December 2019 and before ever again.”

Jones Lang LaSalle IP

Jones Lang LaSalle IPMany of the class B and C office spaces and more obsolete suburban campus locations — or older, urban building stock — may be looking at obsolescence or repurposing, as was also the case during the Great Recession, Miscovich said.

Class B and C buildings are typically older real estate, or those located in a suburban setting, with fewer amenities and lower-tech infrastructure. Prior to the pandemic, many older buildings were considered desirable because they were less expensive to lease.

Corporations are also adopting more of a collaborative space or “hot-desking” model, where desks are shared, depending on scheduled office work days, Ryan explained.

“A larger share of people won’t have a permanent desk,” Ryan said. “For the overall market, in terms of demand you can expect a meaningful decrease in office space use over the long term compared to where they are now.”

Some key cities around the globe have fared better than the overall trend, and occupancy rates were on the upswing over the past several months. London office occupancy rates peaked at 42% on March 10, the highest single daily rate in the capital since before the pandemic in 2020, according to Freespace. (Freespace’s data is derived from over 120,000 sensors in offices around the globe that measure building occupancy and environmental conditions.)

Total office leasing activity turned a corner in 2021. Leasing activity was up 13.3% year-over-year (YoY), and Q4 leasing was up 29% from Q4 2020, according to a report by Cushman & Wakeman. That leasing demand is having a negative impact on the sublease market.

North American sublease inventory trended down in the last two quarters of 2021, after seven quarters of increasing inventory. Subleasing is an indicator of corporations filling empty office space, just as a renter can sublease an apartment. So, when sub-leasing trends down, it’s an indicator that companies are pulling back to occupying their own leased spaces.

“The timing matches a similar path to the previous two recessions when sublease space increased for approximately two years before hitting its high point and receding,” a report from Cushman & Wakeman, a global commercial real estate broker.

In Q4 2021, North American sublease inventory declined by 4.8% quarter-over-quarter (QoQ). Current inventory is 138.1 million square feet (msf), down from 145.1 msf in the previous quarter.

While commercial office space leasing is ticking up, JLL’s Ryan cautioned COVID-19 surges could once again knock back recent gains.

“The general consensus and sentiment among workers around office safety and worker mobility [commuting] seems to be returning to normal levels. It’s just that office re-entry has been held back to date,” Ryan said. “Obviously, we’ve been here before, and we know sometimes these things have gotten derailed, but it does feel different this time, especially as there are no restrictions anywhere.”

Copyright © 2022 IDG Communications, Inc.